Chainlets

Chainlets

Forecasting Bitcoin Price with Graph Chainlets

Abstract

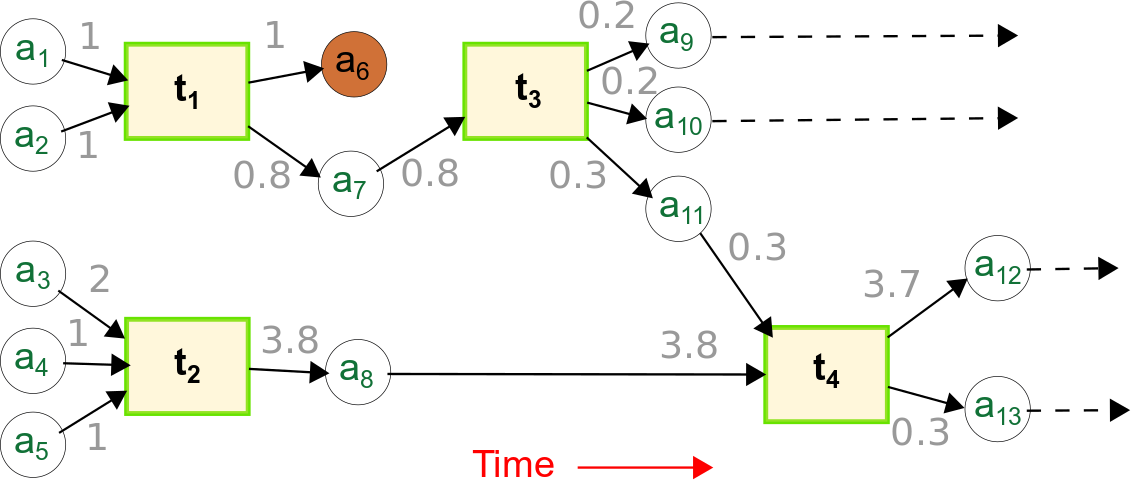

Over the last couple of years, Bitcoin cryptocurrency and the Blockchain technology that forms the basis of Bitcoin have witnessed a flood of attention. In contrast to fiat currencies used worldwide, the Bitcoin distributed ledger is publicly available by design. This facilitates observing all financial interactions on the network, and analyzing how the network evolves in time. We introduce a novel concept of chainlets, or Bitcoin subgraphs, which allows us to evaluate the local topological structure of the Bitcoin graph over time. Furthermore, we assess the role of chainlets on Bitcoin price formation and dynamics. We investigate the predictive Granger causality of chainlets and identify certain types of chainlets that exhibit the highest predictive influence on Bitcoin price and investment risk.

#More detail can easily be written here using Markdown and $\rm \LaTeX$ math code.